Cat N vs. Cat S: Real-world examples

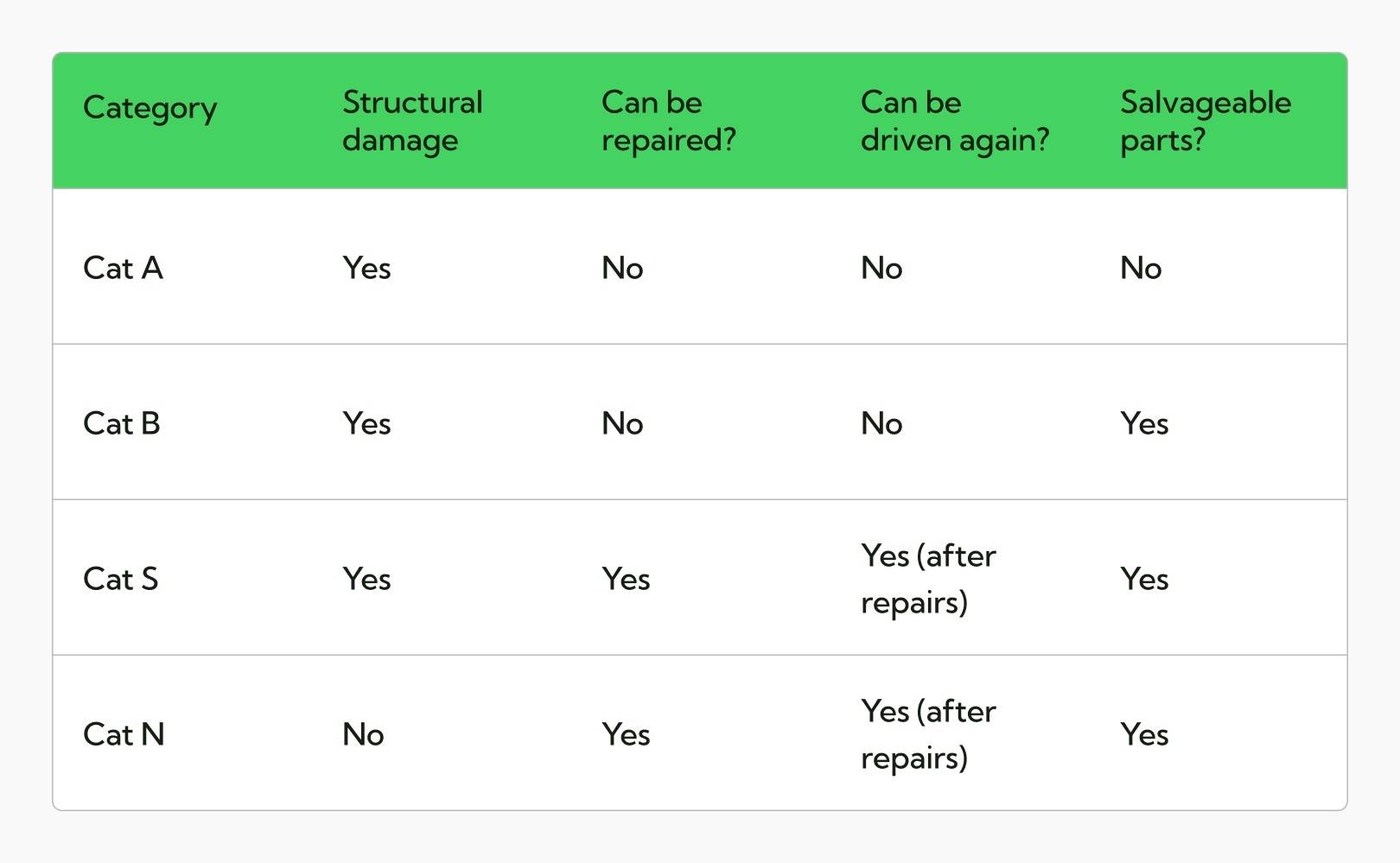

Since Cat A and Cat B are not repairable under any circumstances, let’s focus on the differences between Cat S and Cat N.

To help you grasp the concept, here are two hypotheticals:

-

Cat N: A car with a damaged bumper, broken headlights, and a faulty infotainment system. No structural issues, just expensive to fix.

-

Cat S Example: A car with a bent chassis or compromised suspension system. Still fixable, but repairs are more serious and require expert work.

The key difference? Cat S cars have structural issues. Cat N cars don’t.

Now... That doesn’t always mean they’re the safer or easier option. A Cat N vehicle with electrical faults can be more complex (and costly) to sort out than a structurally damaged Cat S car. Always dig into the details.

Common causes for Cat N classification

Not all write-offs are dramatic crashes. Many Category N cars end up on the list for reasons that sound minor (at least on the surface).

Here are some of the most common causes:

Flood damage

Water doesn’t have to reach the engine to cause major issues. If a car’s electronics, sensors, or infotainment system are compromised in a flood, insurers may write it off. Even if the structure is untouched, diagnosing and repairing water-damaged electronics can be expensive and unpredictable.

Cosmetic damage

A smashed bumper, scratched panels, or deep paint damage might not sound serious. And structurally, it often isn’t. But if the cost of repairs adds up to more than the car’s market value, it can be classed as Cat N. This is especially common with older vehicles or those with lower resale value.

Airbag deployment without frame damage

Airbags are costly to replace. And if they go off during a collision, that alone can tip the car over into write-off territory. If there’s no structural damage and only the airbags and interior need replacing, it’s typically marked as Cat N.

Theft recovery

Cars that are stolen and later recovered often show up with minor damage: missing wheels, stripped interiors, or cosmetic scrapes. If the repairs are costly but non-structural, the insurer may write it off as Cat N.

Electrical or ECU faults

Modern cars are packed with sensors and software. If the ECU (engine control unit) or other electronic systems fail and repairs are too complex or pricey, the car can be written off even without a scratch to the frame.

Is it safe to buy a Cat N car?

Yes, but only if you do your homework.

A Cat N car can be perfectly safe to drive once it’s been properly repaired. Since the damage wasn’t structural, the car’s frame and crash zones are still intact. That’s a good start, but safety depends on the quality of the repairs, not just the classification.

-

Get a full inspection. Don’t rely on surface-level checks. Pay for a professional inspection to look at the mechanical, electrical, and safety systems, especially if the car had flood damage or airbag deployment.

-

Request the car's repair history. Ask for receipts, before-and-after photos, or any documentation showing what was damaged and how it was fixed.

-

Look for warning signs. Misaligned panels, dashboard warning lights, or faulty electronics can signal rushed or incomplete repairs.

-

Consider the long-term ramifications. These depend on the extent of the damage and repairs, and where they happened. If it's a stolen car that was returned practically the same, you've nothing to worry about. Flood damage, though? You might have electrical issues or rusting later on.

These are things you should consider when buying a used car no matter what, but they especially apply to Cat N write-offs.

Pros and cons of buying a Cat N car

There are plenty of reasons to consider a Cat N write-off over a new or standard used car. If you're in the market for one, though, you should know what you're potentially getting yourself into.

Pros:

-

Lower purchase price: Cat N cars are typically 20–40% cheaper than their non-written-off equivalents. That can mean major savings, especially if you’re buying outright.

-

Good value for capable buyers: If you’re handy with repairs or know a trusted mechanic, you might get a perfectly roadworthy car at a steep discount.

-

Insurance-approved repairs (in some cases): If the car was repaired through an insurance-authorised shop, there'll be a paper trail and evidence of professional work, giving you added peace of mind.

Cons:

-

Lower resale value: Even once repaired, Cat N cars carry a stigma. Paying less when you buy means you'll also get less back when you sell the written-off car, and some buyers won’t consider it at all.

-

Harder to insure: Most insurers charge more to insure a Car N vehicle. Some will even require inspections, or flat-our won’t cover Cat N vehicles at all. Your options may be limited.

-

Unknown repair quality: Not all fixes are equal. Poorly repaired electrics, hidden water damage, or dodgy aftermarket parts can lead to expensive surprises later.

-

Financing can be tricky: Lots of lenders won’t finance Cat N cars, or they’ll offer less favourable terms. If you’re not paying in cash, this is something to check upfront.

How to check if a car is Cat N

Before you commit to any used car, checking its history is a crucial first step.

Here’s how to find out if a vehicle is Category N:

-

Run a vehicle history check.

Use a reputable service like the HPI Check, AutoTrader Vehicle Check, or our free MOT history service. These reports will show if a car has been written off, when it happened, and what category it was given.

-

Ask the seller directly.

Legitimate dealers are required to disclose a Cat N status. If a private seller seems evasive or says “I’m not sure,” treat that as a red flag.

-

Check the V5C (logbook)

The logbook won’t show the write-off category. But you can match it against the vehicle check report to confirm the details align, including previous owners, colour, and registration dates.

How much are Cat N cars worth?

On average, a Cat N car is worth 20% to 40% less than the same make and model with a clean history. Luxury and premium vehicles often lose even more, not because they’re riskier, but because their repair costs are higher, and buyers expect perfection.

The exact drop depends on:

-

The age and mileage of the vehicle

-

The extent of the original damage

-

The quality of the repairs

-

The brand’s reputation (some hold value better than others)

For example:

A clean 2018 VW Golf might sell for £11,000

The Cat N Golf, post-repair, would fetch just £7,500–£8,500

If the repairs were professionally documented, sellers will normally price the car closer to the high end of Cat N value. If there’s no paperwork, expect a bigger discount.

The reason sellers usually list Cat N cars at a noticeable discount is to attract interest. Most advertise the status openly, but you’ll still want to cross-reference the vehicle history report to verify it.

Tip: Always compare prices using the same (or close to the same) make, model, year, mileage, and trim level. That gives you the clearest picture of the Cat N effect.

Repairing a Cat N car

Who can legally repair a Cat N car?

One of the reasons Cat N cars are so common on the road is that any competent individual, body shop, or garage can legally repair them. Unlike Cat S vehicles, there's also no legal requirement for them to be re-inspected before being sold.

Is a VIC (Vehicle Identity Check) required?

Not anymore. The old VIC scheme was scrapped in 2015. For Cat N cars, there’s no need for an official inspection before getting back on the road. As long as the car is roadworthy and passes its MOT, you’re good to go.

However, this also means the burden of quality control is on the buyer. You’re relying on whoever repaired the car to have done it right (which is why documentation matters so much).

Original vs. used parts

The flexibility of repair options makes Cat N cars cheaper to return to the road, but it also opens the door to poor-quality fixes.

Some repairs use OEM (original equipment manufacturer) parts, while others rely on used or aftermarket components to keep costs down. Used parts aren’t always a problem — e.g., for panels, lights, or interiors. For safety systems (like airbags or brakes), though, original parts are strongly recommended.

Good sellers will keep:

-

Photos of the car before and after repairs

-

A list of parts replaced

-

Receipts for labour and components

-

Details of the workshop or mechanic who did the work

This info is also important for you to keep, for when you insure (and possibly resell) it.

Do repairs need to be declared?

Yes. The Consumer Protection from Unfair Trading Regulations of 2008 addresses unfair trading practices.

While the verbiage is broad and open to interpretation, the core idea is simple: anything that would cause the average person to buy a used car when they otherwise wouldn't have is considered "unfair".

If you're dishonest about what was repaired or how the work was carried out, you're essentially tricking the buyer into purchasing the car.

Selling a Cat N car

Selling a Cat N car comes with a few extra steps and a bit more scrutiny. But if you’re transparent and prepared, you can definitely get a fair deal.

Legal Requirements for Disclosure

By law, you must disclose that the car is a Category N write-off when selling it. Whether you’re selling privately or to a dealer, withholding that information is considered misrepresentation, which can lead to legal action if the buyer finds out later.

Even if you’ve repaired the car to a high standard, the Cat N label sticks with it for life. You can’t “clean” the title, so honesty is non-negotiable.

What to include in your advert

Be upfront, but informative. A good listing should include:

-

A clear indication that it’s Cat N

-

A brief description of the damage it sustained

-

What repairs were made, and who did them

-

Any before-and-after photos or paperwork

-

Confirmation that it has a valid MOT

If the work was professionally done, say so. It helps position the car as well-cared for rather than suspiciously cheap.

Rebuilding trust with potential buyers

Cat N status makes buyers cautious, so your job is to reassure through transparency.

-

Offer a full inspection report (or let buyers bring their own mechanic)

-

Provide all repair documentation, receipts, and photos

-

Highlight any upgrades or recent maintenance

-

Be prepared to answer tough questions

The more detail you provide, the more credible you’ll seem.

Selling to dealers vs. private sale

Private sales often net you a higher price, but they come with all the legwork. You’ll need to deal with tyre-kickers, answer lots of questions to multiple people, and prove the car’s history.

Dealers, especially those who specialise in salvage or budget vehicles, offer a quicker, easier sale, but at a lower price.

They know the resale challenges and will factor that into their offer.

Is part-exchange possible with Cat N cars?

Yes, but again, expect a lower trade-in value than you'd get with a clean-title car.

Most main dealers won’t accept Cat N cars at all, but used car dealers may. Just be upfront about the vehicle’s status and provide documentation to support its condition.

If it’s well-repaired and has a current MOT, they might still consider it as part-exchange, especially if you're looking to buy a lower-value car.

Can a Cat N status be removed or reclassified?

No. Once a car is given Cat N status, it stays that way permanently. This status is logged with the DVLA and visible on any vehicle history check. That means future buyers, insurers, and dealers will always know the car was previously written off.

Even if the vehicle is fully repaired and passes every MOT with flying colours, the Category N designation is still recorded in its history. You can’t appeal it, reverse it, or “upgrade” it later. It’s not like a scratch that gets buffed out.

Challenging your insurer's write-off decision

If it's your car that has been written off as Category N and you feel it shouldn’t have been, you do have some options:

-

Request a full explanation, including estimated repair costs, vehicle valuation, and any inspection reports.

-

Challenge the valuation that led to the write-off by submitting evidence to support a higher market value (e.g., recent sale prices for similar cars, service history, or recent upgrades).

-

Get a second opinion from an independent engineer who can assess the damage

Again, this can support your case in negotiations, but it won’t erase the Cat N status once it’s recorded.

Importing or exporting a Cat N car

Even though other jurisdictions might not recognise UK insurance categories, you can't "clean" the title by selling it abroad, either.

To legally sell your car:

-

Complete the 'permanent export' section of your V5C logbook and send it to the DVLA, keeping the remainder of the V5C for vehicle registration in the destination country.

-

Gather all the required documents, plus a Certificate of Conformity (COC) from the manufacturer and anything else required by the importing country.

-

Research the specific import regulations of the country to which you're exporting (e.g., taxes, inspections, environmental/safety standards).

Also remember that, while the Cat N classification is a UK-specific designation, transparency about the vehicle's history is crucial.

Category N cars and vehicle financing

Mainstream lenders and banks are cautious about write-offs. Some won’t finance Cat N cars at all, while others will only do so under stricter terms. That’s because a Cat N vehicle carries a higher perceived risk: its resale value is lower, its repair history may be unclear, and in the event of another claim, the payout could be reduced.

Even if financing is available, you might face:

-

Higher interest rates

-

A lower maximum loan amount

-

A requirement for a larger deposit

-

Mandatory vehicle inspections before approval

Leasing is even less likely. Most leasing companies require the vehicle to have a clean history, since they expect to resell or re-lease it after the contract ends.

Your best shot is with specialist lenders who deal with used or salvage vehicles. They understand the market better, but expect more paperwork and a closer look at the car’s repair documentation.

How to spot a poorly repaired Cat N car

When it comes to Cat N cars, the difference between a bargain and a money pit often comes down to quality.

Here are a few simple things to check before you buy:

-

Panel gaps and alignment: Uneven gaps between doors, bonnet, or boot point to rushed or inaccurate repairs.

-

Paint mismatches: Look at the car in natural light. If one panel looks slightly different in colour or texture, it may have been resprayed.

-

Warning lights: Turn the ignition on and check the dashboard. Any light that stays on, especially for airbags, ABS, or traction control, is a red flag.

-

Electrical issues: Test everything. Windows, infotainment, aircon, indicators, central locking. Faulty electronics are common in Cat N cars with flood or wiring damage.

-

Under the bonnet: Check for signs of new parts mixed with old ones, poor fitting, or unlabelled aftermarket components.

-

Test drive: Listen for strange noises, pulling to one side, or vibrations.

If anything feels “just not right,” get an independent mechanic to inspect the vehicle. A £100 pre-purchase check could save you thousands.

Category N and electric vehicles (EVs)

EVs are packed with complex electronics, sensors, and safety tech like ADAS (Advanced Driver Assistance Systems). Even a minor bump can affect systems like lane-keeping, adaptive cruise control, or emergency braking.

If these components are damaged (particularly the radar units or cameras), they can be extremely costly to diagnose and repair, even if the structure of the car is untouched.

The battery is another major factor. A damaged or water-exposed battery doesn’t need to catch fire to be written off.

The sheer cost of replacement (often upwards of £10,000) can push an insurer to classify the car as Cat N.

This is one reason why more EVs are ending up with Cat N status. Small collisions or electrical faults can easily result in write-offs, not because the damage is catastrophic, but because repair costs outweigh the car’s value.

So, is buying a Cat N electric vehicle worth it?

Maybe, but only if you know exactly what you’re dealing with. Get a full diagnostic check, confirm the battery is healthy, and ensure all ADAS features function properly. Without that, you could be buying a high-tech headache.

Legal considerations for Cat N cars

We've already covered the fact that it's illegal to sell a Cat N car without disclosing the salvage title (this is public info anyway). However, there are a few other legal considerations you should be aware of when it comes to these types of vehicles.

What to do if you unknowingly bought a Cat N car

Your rights depend on the kind of seller you went through.

If you purchased through a dealer:

Under the Consumer Rights Act 2015, dealers are obligated to sell vehicles that are:

-

Of satisfactory quality

-

Fit for purpose

-

As described

Their failure to disclose your vehicle's Cat N status could breach that.

If the purchase was made within the last 30 days, you might be entitled to reject the vehicle and request a full refund. Beyond that period, you can still seek a repair, replacement, or partial refund, so long as you can substantiate the misrepresentation.

If you purchased on the private market:

Private sellers have fewer obligations, but you could have grounds for a claim if you inquired about the car's history and were misled. If you made no such inquiry, recourse options may be limited.

-

Document everything. Gather all relevant documents, including the sales agreement, advertisements, and any correspondence with the seller.

-

Contact the seller. Approach the seller to discuss the issue and seek a resolution privately.

-

Get advice. If the seller is uncooperative, contact the Citizens Advice consumer helpline at 0808 223 1133 or visit

-

Citizens Advice. They can offer guidance and may refer the matter to Trading Standards if necessary.

-

Pursue legal action. As a last resort, you could pursue a claim through the small claims court. The process involves submitting a claim online and may require a fee. Be prepared to present evidence supporting your case.

Expert tips for first-time buyers of Cat N vehicles

You've already heard the usual advice: check the history, inspect the repairs, be cautious. Here are our eight pro-level tips — the ones that'll save you thousands and protect you from a bad buy.

1. Ask for invoices, not just photos.

Before-and-after pictures are helpful, but they can be staged. Pros ask for itemised repair receipts from the garage, body shop, or parts supplier. This proves what was actually replaced and whether OEM or used parts were used.

2. Check the airbag module via diagnostic scan.

Even if the airbag warning light is off, that doesn’t mean the system was properly reset or replaced. A quick diagnostic scan can reveal if there’s a fault hidden under the surface — a common trick dodgy sellers miss.

3. Look for mismatched glass.

Windscreens and windows carry a small brand/date mark. If one is noticeably newer, it might point to past damage the seller didn't disclose. This is especially relevant if flood or theft damage was involved.

4. Research the insurer and claim details.

Some insurers are more cautious than others. A car written off by one company might not have been by another. If you ask which insurer handled the claim and why it was classified as Cat N, the answer can say a lot about the car's real condition.

5. Avoid “just registered” V5Cs.

If the logbook shows the car was recently re-registered or has a new keeper very recently, it could be a flipper offloading a quick repair job. Pros look for ownership history that shows a bit of time after the repair. Ideally, someone who’s driven it for a few months.

6. Watch for missing undertrays and fasteners.

Check underneath the car. Shoddy repairs usually skip non-essential parts like splash guards or use cable ties and non-OEM bolts. Small details, but they reveal the repair quality better than polished paint ever could.

7. Cross-reference MOT advisories with repair dates.

If a car was repaired six months ago, but the MOT last month still flags alignment issues or electrical faults, it’s a sign the job wasn’t done right. Check if the timeline of the repair matches the MOT history.

8. Don’t buy without a cool start and a test drive.

A car that starts easily from cold and behaves normally under driving conditions is far more trustworthy than one that’s been warmed up before you arrive. Cold starts show battery health, starting system integrity, and early misfires/electrical quirks.

Can a Category N car pass an MOT?

Yes, a Category N car can pass its MOT as long as it’s roadworthy and meets all legal safety and emissions standards. The Cat N label doesn’t automatically fail a car, but it’s crucial the repairs were done properly before the test.

Are Cat N cars road legal?

Cat N cars are completely road legal once repaired. Unlike write-off categories A and B, they don’t require reinspection or special approval. As long as the vehicle's insured, taxed, and has a valid MOT, you can drive it on public roads just like any other car.

Will Cat N affect my insurance premium?

Yes, insuring a Cat N car is generally more expensive. Some insurers charge higher premiums, impose conditions, or refuse to cover it altogether. It varies by provider, so it’s best to shop around and disclose the Cat N status upfront to avoid surprises.

How do I know a Cat N car was repaired properly?

Check for documentation like repair receipts, part invoices, and before-and-after photos. A professional inspection or diagnostic scan adds extra peace of mind. Well-done repairs leave no warning lights, no strange noises, and no panel misalignments. Anything less should raise concern.

The bottom line

Buying a Category N car isn’t automatically a bad move, but it’s definitely not something to rush into.

You can get real value if the repairs were done right, the price reflects the risks, and you know what you’re looking for. But if you skip the checks or let a cheap price cloud your judgement, you'll end up with more problems than pound savings.

Buying a Cat N car? Learn about its history by using our free MOT status and history checker.