Quickly check whether your vehicle is taxed in the UK

Vehicle Excise Duty is a legal requirement for every car driven or kept on a public road in the UK, with no exceptions. Even if you don’t have to pay anything due to a payment exemption (like a historic vehicle), you’re still required to register it as ‘taxed’ with the DVLA.

How much you pay depends on when your car was first registered and how much CO2 it emits. Older, more polluting vehicles generally pay more. Most cars registered after April 2017 pay a flat £195 a year from year two onwards, but the first year tax ranges from £10 for zero-emission EVs to over £2,000 for high-emissions vehicles.

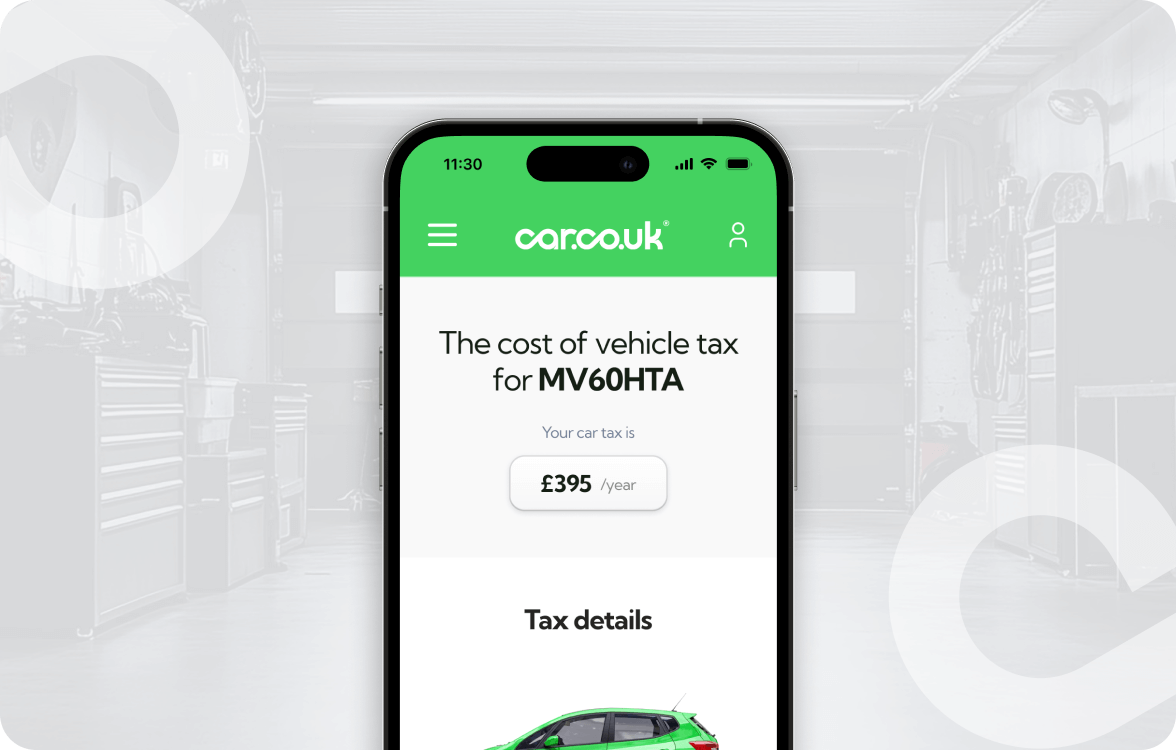

If you want to know the tax status of any vehicle, you can check it in seconds on Car.co.uk, completely free. Just enter the registration number into the search bar. We pull the data directly from the DVLA and DVSA, so what you're seeing is accurate and up to date. Within moments you'll have the full picture: whether the vehicle is currently taxed, when that tax expires, whether it's registered as SORN and the latest MOT information.

The whole thing takes about 30 seconds, and you won’t need to make an account or enter anything besides your reg number.

Best price given for your car in 30 seconds

How to check your car tax status for free

What’s included in your free car tax check?

Why is it important to know your vehicle’s tax status?

How to pay or renew your car tax online

- If your tax has already expired, renew it immediately via GOV.UK. Driving or even parking an untaxed vehicle on a public road is illegal and the DVLA can issue fines or arrange for the car to be clamped without warning.

- The cost varies depending on your car's age, fuel type, and CO2 emissions. Most cars registered after April 2017 pay a flat £195 a year from year two, though rates shift annually in line with inflation, so it's worth checking the latest figures before you renew.

- To tax your car, head to GOV.UK and search ‘tax your vehicle’. You'll need your V11 reminder letter reference number, or your V5C logbook if you don't have one. The whole process takes a few minutes online.

- Before you can tax your car, you'll need valid insurance cover and, if your car is over three years old, a valid MOT. Without both of these in place, the DVLA won't let the transaction go through.

UK legal driving requirements

Car tax FAQs

Vehicle Excise Duty (VED) is the annual tax you pay to legally drive or keep a vehicle on UK public roads. It's commonly called road tax or car tax, though technically it's not a tax on the road itself; it goes straight into general government funds.

How much you pay for VED depends on your car's age, fuel type and CO2 emissions. Most cars registered after April 2017 pay a flat standard rate of £195 a year from year two onwards. Older cars fall into one of 13 emissions bands, and pre-2001 vehicles are taxed on engine size instead. Rates nudge up each April in line with inflation.

Yes, as long as you have the car’s registration number, you can check its tax status even if it doesn’t belong to you. Our checker is completely open, so you can look up any UK-registered vehicle without needing to be the owner.

Since all the info is publicly available, this is particularly useful if you're buying a used car and want to verify the tax status before committing, or if you want to check a vehicle you're about to borrow or drive.

To renew your car tax you'll need either your V11 reminder letter, which the DVLA sends out automatically before your tax expires, or your V5C logbook if you don't have a V11 letter to hand. You'll also need valid car insurance before taxing the cart. And if your car is over three years old, you’ll need a valid MOT as well.

From April 2026, electric vehicles will move fully into the standard VED system, meaning zero-emission cars are taxed on the same basis as petrol and diesel vehicles. The main change for EV owners is a revised Expensive Car Supplement threshold — a £50,000 threshold applies exclusively to zero-emission cars.

This is actually a slight relief compared to the £40,000 threshold that applies to petrol and diesel vehicles. But still, if you drive or manage a fleet of electric vehicles, it's worth factoring these costs into your planning sooner rather than later.

Yes, VED rates typically increase each April in line with the Retail Price Index (RPI), so the amount you pay will usually nudge up slightly year on year. The standard rate for most cars registered after April 2017 is £200 after 1 April 2026, but that figure will change again come April 2027.

First-year rates and the Expensive Car Supplement are also subject to change, and the government can adjust the wider band structure at any Budget. That’s why it’s always worth checking the current rates and using our service to calculate your car tax before you renew.

Yes, Automatic Number Plate Recognition (ANPR) cameras can instantly cross-reference any plate against the DVLA's databases and flag untaxed vehicles in real time. The police and DVLA use these cameras extensively across UK roads, so the idea that you can quietly get away with driving untaxed is pretty much a myth at this point.

If you're caught, the car can be clamped and potentially seized on the spot. And fines start at £80 but rise significantly if the situation goes further. It's genuinely not worth the risk.

The information displayed on Car.co.uk is 100% accurate because we pull directly from the DVLA and DVSA's official databases (the same records used by the government itself). There's no manual input or third-party interpretation involved, so what you're seeing is the live, up-to-date status of the vehicle.

The only caveat worth knowing is that if a keeper has only just taxed or SORNed their car, there can occasionally be a short delay before the DVLA updates their own records, but that's on their end, not ours.

Additional tax rates generally apply to brand new cars being taxed for the first time, because first-year VED is calculated based on CO2 emissions, and newer vehicles have more precise emissions data available at the point of registration.

Cars with a list price over £40,000 (or £50,000 for EVs) also have an Expensive Car Supplement of £440 a year on top of the standard rate, payable for five years from the second year of registration.

You can check whether either applies to your vehicle instantly using our free checker above.

Cars with a list price over £40,000 and EVs over £50,000 are subject to an Expensive Car Supplement on top of the standard annual VED rate. As of 2025/26 that supplement sits at £440 a year, applied from the second year of registration for five years.

It's worth noting this figure increases each April in line with inflation, so the exact amount you pay will depend on when you're reading this. You can check the current rate on GOV.UK, or use our free checker to see what applies to your specific vehicle.

Yes, SORN status is included in every free vehicle check on Car.co.uk. A SORN (Statutory Off Road Notification) means the registered keeper has officially declared the vehicle off the road, so it can't legally be driven or parked on a public road.

If you're looking at buying a used car and it comes back as SORN, that's worth investigating because it means the car hasn't been taxed and may have been sitting unused for a while (which can point to underlying issues).

For high-value new cars, anything with a list price over £40,000 attracts an Expensive Car Supplement on top of the standard VED rate, which is currently £440 a year for five years from the second year of registration, though this shifts annually.

For used cars, the supplement only applies if the original list price exceeded the threshold when the car was brand new, regardless of what it sells for second-hand. So a £40,000 car that's now worth £15,000 can still be carrying that additional charge. Again, always worth checking before you buy.

Yes, our car tax checker works for any UK-registered vehicle, including electric cars. Since April 2025, EVs are no longer exempt from VED and are taxed at the standard rate of £195 a year, so checking the tax status of an electric vehicle is just as relevant as it is for a petrol or diesel car.

Simply enter the registration number and you'll get the full picture instantly, including tax status, expiry date, and whether the vehicle is SORN.